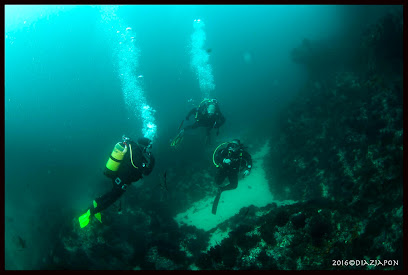

Address, phone, full description, and reviews of Ocean Addicts Tarifa

Address, phone, hours, and contact of Ocean Addicts Tarifa

Address: Puerto Deportivo, Local 1, 11380 Tarifa, Cádiz

Phone: 638 48 10 35

Email: info@oceanaddicts.es

Website: http://www.oceanaddicts.es/

Main services: Centro de buceo

Reviews: This dive center has over 392.0 positive reviews on Google My Business.

Hours: martes, De 9:00 a 19:00; miércoles, De 9:00 a 19:00; jueves, De 9:00 a 19:00; viernes, De 9:00 a 19:00; sábado, De 9:00 a 19:00; domingo, De 9:00 a 19:00; lunes, De 9:00 a 19:00

Location Map – Where is Ocean Addicts Tarifa?

Reviews Ocean Addicts Tarifa

Ocean Addicts Tarifa has 392.0 reviews on Google with an average rating of 4,8 stars

Understanding the Importance of Financial Literacy

Financial literacy is a critical skill that is often overlooked in today’s society. Many individuals lack the basic knowledge and understanding of financial concepts, which can lead to poor financial decision-making and long-term repercussions. In this article, we will explore the importance of financial literacy and how it can positively impact individuals and communities.

Financial Literacy: What Is It?

Financial literacy refers to the ability to understand and effectively use various financial skills, including personal financial management, budgeting, investing, and understanding credit and debt. It encompasses the knowledge and skills necessary to make informed and effective decisions about money. Financially literate individuals have the ability to manage their finances effectively and understand financial risks, rewards, and consequences.

The Importance of Financial Literacy

Financial literacy is important for a number of reasons. Firstly, it empowers individuals to make informed and responsible financial decisions. Without a basic understanding of financial concepts, individuals are more likely to make poor choices when it comes to spending, saving, and investing. This can lead to financial hardship and instability, both personally and within communities at large.

Furthermore, financial literacy is essential for long-term financial well-being. Individuals who are financially literate are better equipped to plan for their future, save for retirement, and weather financial storms. They are also more likely to have better credit scores and access to financial products and services that can help them achieve their financial goals.

From a broader perspective, the importance of financial literacy extends to the economy as a whole. When individuals are financially literate, they contribute to the overall economic stability of their communities and society. They are less likely to rely on government assistance and are more likely to contribute to economic growth and prosperity.

The Impact of Financial Illiteracy

Conversely, the impact of financial illiteracy can be quite severe. Individuals who lack basic financial skills are more vulnerable to financial pitfalls and are at a higher risk of falling into debt, bankruptcy, and poverty. This can have a ripple effect on families and communities, leading to increased stress, strained relationships, and a cycle of financial hardship.

Additionally, the impact of financial illiteracy is not limited to individuals. It can also have broader social and economic consequences. A lack of financial literacy can contribute to income inequality, reduced productivity, and increased reliance on social welfare programs. It can also limit entrepreneurship and economic growth, as individuals may lack the confidence and skills to start and sustain successful businesses.

Promoting Financial Literacy

Given the importance of financial literacy, it is crucial to promote and support initiatives that aim to improve financial education and awareness. This can be done through various means, such as educational programs in schools, community outreach efforts, and employer-sponsored financial wellness programs.

Educational institutions play a critical role in promoting financial literacy by integrating financial education into their curriculum. By teaching students about budgeting, saving, investing, and credit, schools can help prepare the next generation to be financially responsible and savvy.

Community organizations and financial institutions can also contribute to promoting financial literacy by offering workshops, seminars, and resources that aim to educate individuals about money management. These initiatives can provide valuable information and support to individuals who may not have access to formal financial education.

Employers can also play a part in promoting financial literacy among their employees. By offering financial wellness programs and resources, employers can help their workforce better understand and manage their finances, leading to improved job satisfaction and productivity.

Conclusion

In conclusion, financial literacy is a crucial skill that has far-reaching implications for individuals, communities, and society at large. By understanding and promoting financial education, we can empower individuals to make informed decisions, improve their financial well-being, and contribute to a more stable and prosperous economy. It is essential that we continue to support and invest in initiatives that promote financial literacy, as the benefits are numerous and far-reaching.

Click the following link to view customer reviews of Ocean Addicts Tarifa